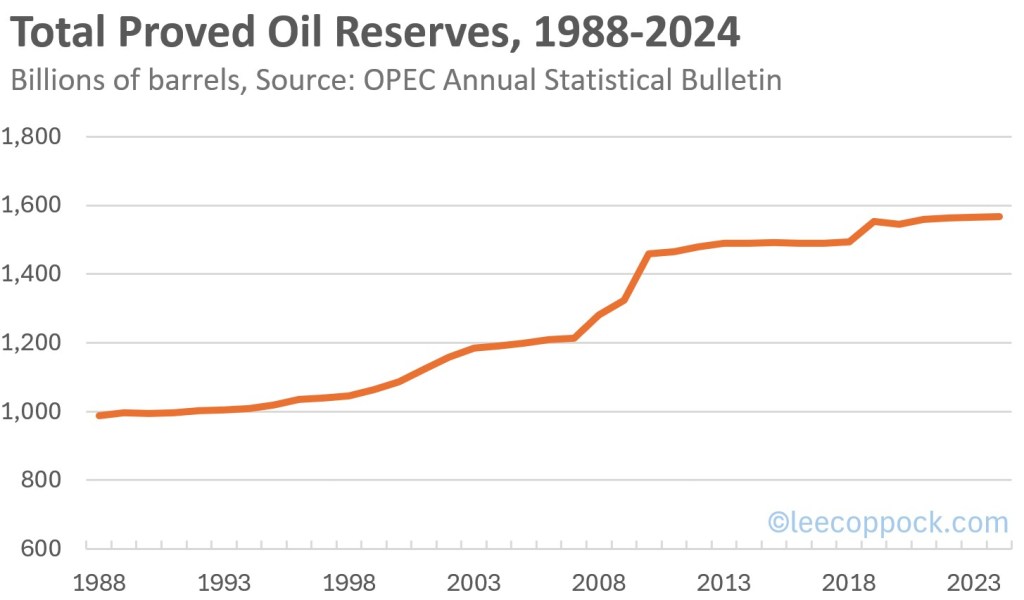

For decades, people have worried about “peak oil,” the idea that we’d eventually run out and watch modern life grind to a halt. And at first glance, that fear seems reasonable: the world consumes about 37 billion barrels of oil per year! Furthermore, in 1990, there were only about 1 trillion barrels of proven oil reserves in the world. However, get this: proven oil reserves actually grow just about every year! In other words, even though we use a staggering amount of oil, total proved reserves keep rising because we keep adding to what counts as “economically recoverable” oil. The figure below shows OPEC data on total proven reserves by year since 1988.

This is a nice real-world illustration of the law of supply, and it’s also a reminder that increasing quantity supplied is not always cheap and easy. The cheap oil tends to get found and developed first, often on land, near existing roads, pipelines, and infrastructure. Offshore oil is a different animal. It requires specialized rigs, massive upfront investment, and a floating industrial operation that has to drill, extract, and transport crude in the middle of the ocean. It’s dramatically more expensive than onshore production, which is exactly why it only makes sense when the expected payoff is high enough. Offshore drilling began in the Gulf of Mexico in 1947, but it became a much bigger part of global supply later, especially with the North Sea boom, where major fields discovered in the early 1970s began producing in 1975.

And if offshore is expensive, Arctic offshore is next-level expensive. In the Arctic, companies face extreme cold, remote locations, short drilling windows, and complex logistics that make projects financially daunting unless prices (and expectations) are strong. In fact, one high-profile Arctic development offshore Norway, Equinor’s Wisting field in the Barents Sea, was publicly described as so costly (over 100 billion Norwegian crowns, roughly $10 billion) that it was paused and later redesigned to bring costs down.

So no, this isn’t magic, and it isn’t a contradiction. It is the law of supply in action. When prices rise, producers go looking harder, drilling deeper, and spending more to find more oil so they can bring it to the market for you and me. Incentives affect behavior.

Leave a comment