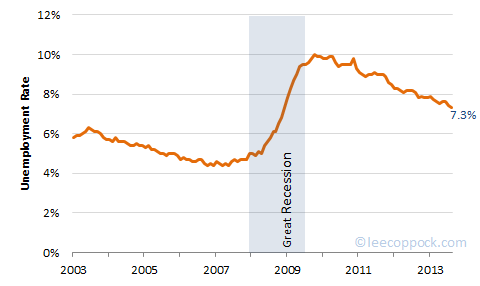

This morning, the BLS released the jobs report for August. The good news is that the unemployment rate dropped to 7.3%, the lowest level in the United States in almost five years (December 2008).

But, to be frank, the jobs report offers some other figures that indicate the economy is not growing robustly.

First, consider employment growth, measured by gains in nonfarm employment. Total nonfarm employment grew by 169,000 jobs in August (not bad).

The bad news is that downward revisions to data from the prior two months indicate that the economy is adding an average of just 148,000 jobs per month, which is not enough to significantly reduce the unemployment rate, especially with labor force participation rates at historically low levels. And that brings us to the other piece of negative news…

The labor force participation rate fell to 63.2%, the lowest level in the U.S. since 1978. This means that millions of Americans continue outside the labor force and the portion of Americans with jobs continues to shrink.