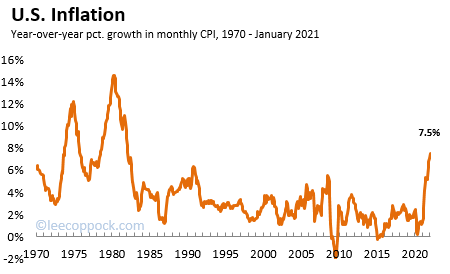

New CPI data released today from the BLS indicates that U.S. inflation is not yet tamed. The graph below shows the one-year growth rate of the CPI on a monthly basis since the beginning of 2022.

After consistent declines since June 2022, inflation has now increased slightly for two months in a row, and is now back up to 3.7 percent. This should worry anybody who hoped that inflation would continue falling down into the 2% range.

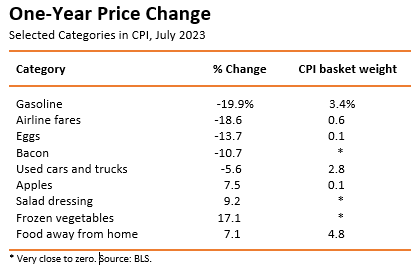

As for particular categories, gasoline prices rose drastically in August, up 10.6% in just one month. Rental housing expenses are also up 7.3% since a year ago. This is particularly difficult for consumers, since about 35% of monthly spending is on housing for an average consumer.

One word of caution: gas prices and housing costs do not cause inflation, they merely reflect inflation. Many other prices in the economy have fallen over the past year (for example, television prices are down 10.1% and washing machines are down 12.8%). Over time, when the overall price level rises (as opposed to changes in the relative prices of goods) it is due to changes in the overall quantity of money in an economy. The quantity of money is hard to measure, but the Federal Reserve does control a large chunk of it, and so monetary policy can definitely affect inflation rates. This means that Jerome Powell's job is not yet done.