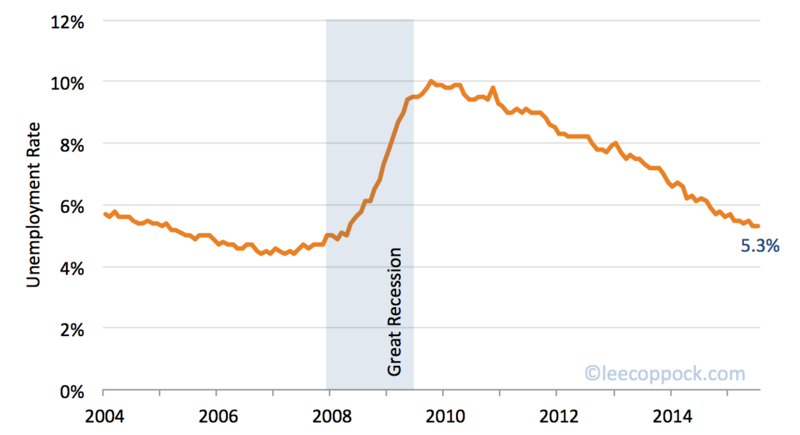

The latest jobs report from the BLS offers a great teaching lesson about how the unemployment rate is calculated. Here's why: it is one of the best jobs reports we've had in a long time even though the unemployment rate actually went up.

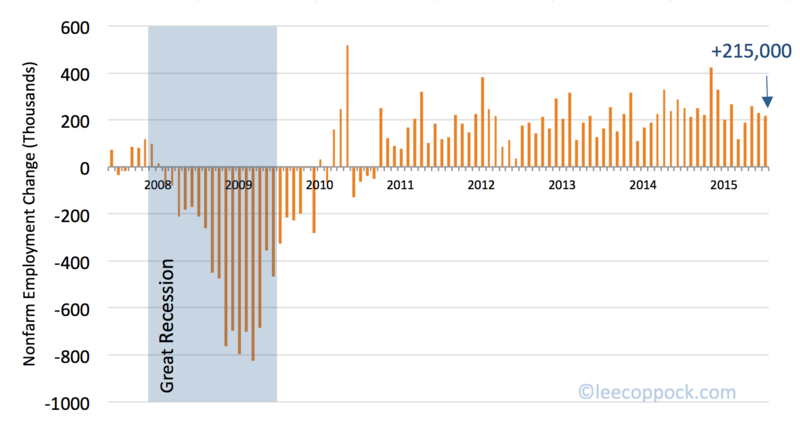

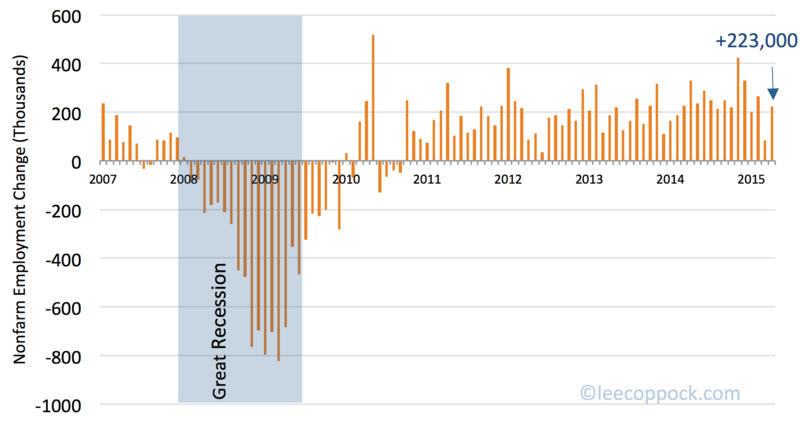

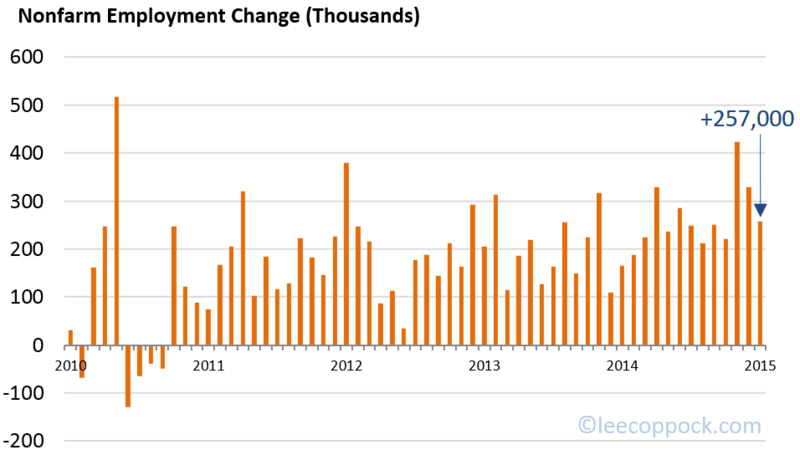

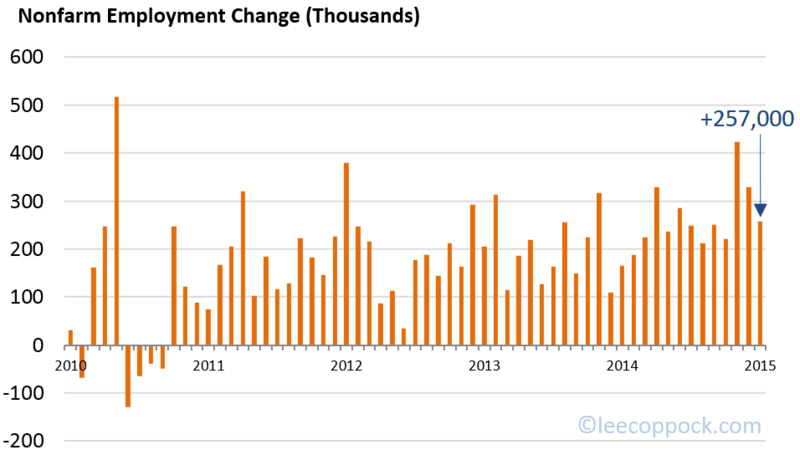

First, notice the 257,000 new jobs created in January. As the graph below shows, we are now working on almost 5 years straight of positive jobs growth, with 3.2 million new jobs in the past twelve months alone.

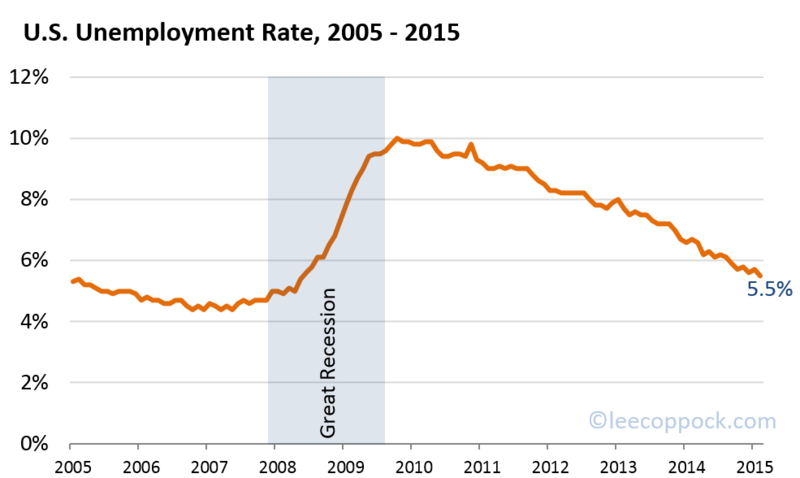

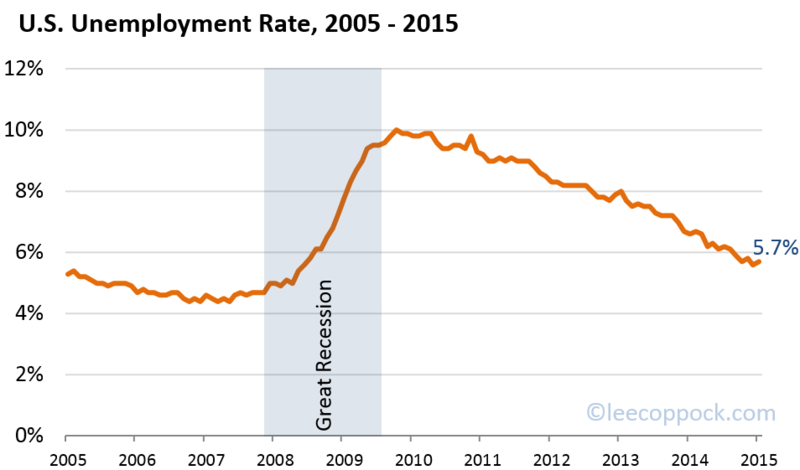

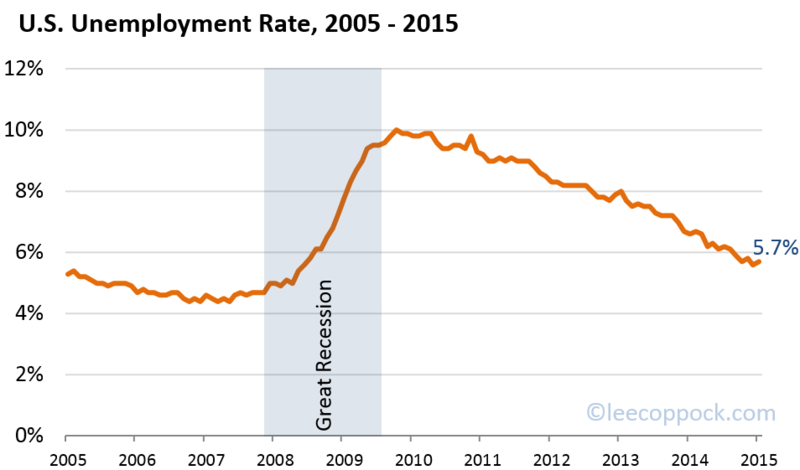

The second piece of good news is the increase in the labor force participation rate (LFPR) to 62.9 percent. And while labor force participation is still at historically low levels (see graph below), it seems possible that the downward trend has finally reversed as the economy is picking up steam.

With all this good news, why did the unemployment rate actually rise to 5.7% in January? It rose because it is calculated as the portion of the labor force that is unemployed. The labor force grew by over one million people in January. And while about one-fourth (257,000) of these found jobs, the others did not, and so the unemployment rate increased.

This tick up in the unemployment rate should not be seen as bad news. In the long run, we want the economy to be producing lots of jobs – jobs that draw people back into the labor force from disability, continued education, and perhaps even retirement.