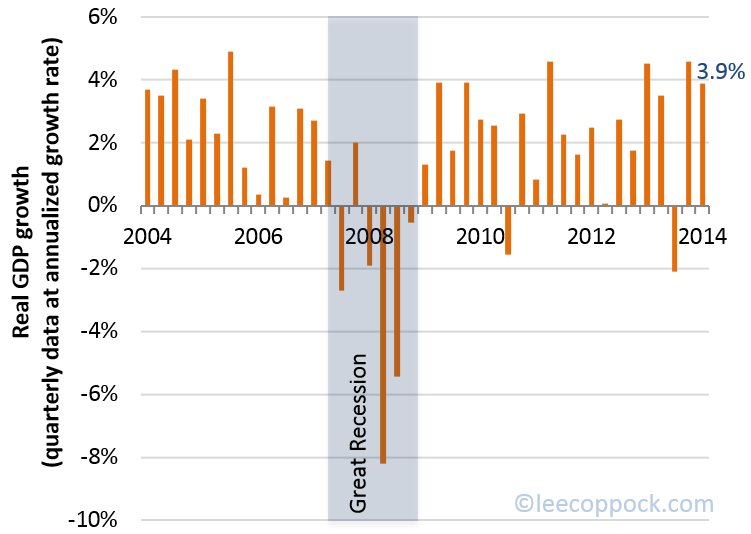

Real GDP grew at a mediocre 2.6% in the fourth quarter of 2014, according to the latest release from the BEA. Keep in mind, this is the first estimate of real output for last quarter and subsequent revisions have been significant recently. However, if this estimate holds up, it means that 2014 ended on a relatively weak note, after two very promising quarters. The graph below shows quarterly real GDP growth for 2013 and 2014:

As the figure shows, 2014 was a mixed bag – with 2.4% growth for the calendar year. The first quarter brought negative growth, probably supply and weather-related. The second and third quarters both brought strong growth, but then that seems to have tapered off by the end of the year. This followed just 2.2% growth in 2013.

But the long run picture certainly looks better than just a few years ago. We now have five consecutive years of positive annual growth. This graph shows the path of real GDP over the past fifty years:

Growth over the past five years hasn't been explosive, at just 2.2% (versus 3% over the last fifty years), but the expansion period since the Great Recession, which ended in June 2009, is now over five years.

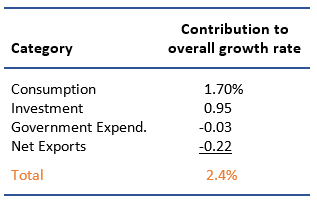

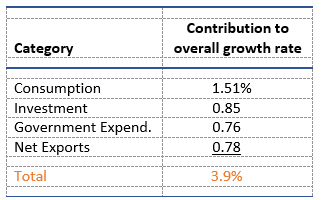

Finally, we can look at the contribution to growth from the four components of GDP in 2014:

Over the course of the year, consumption contributed the most to growth but investment was also up. Expenditures by all levels of government in 2014 were essentially flat, and net exports fell slightly (imports increased more than exports).

The next GDP update is scheduled for February 27.