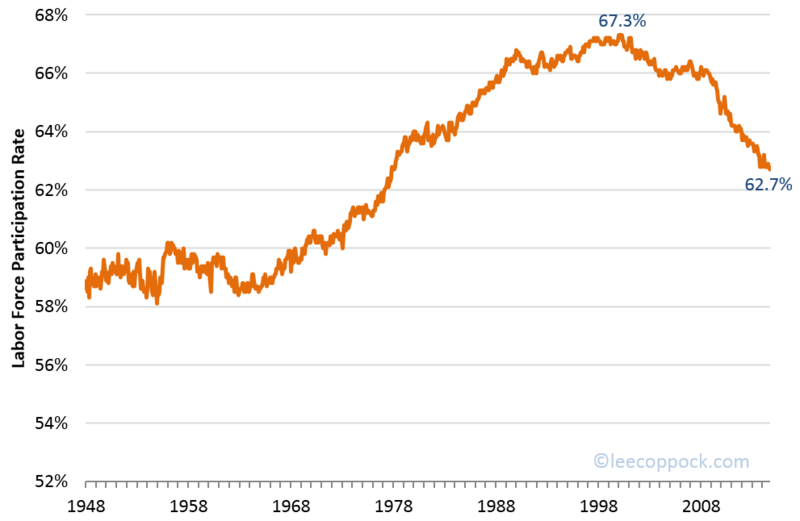

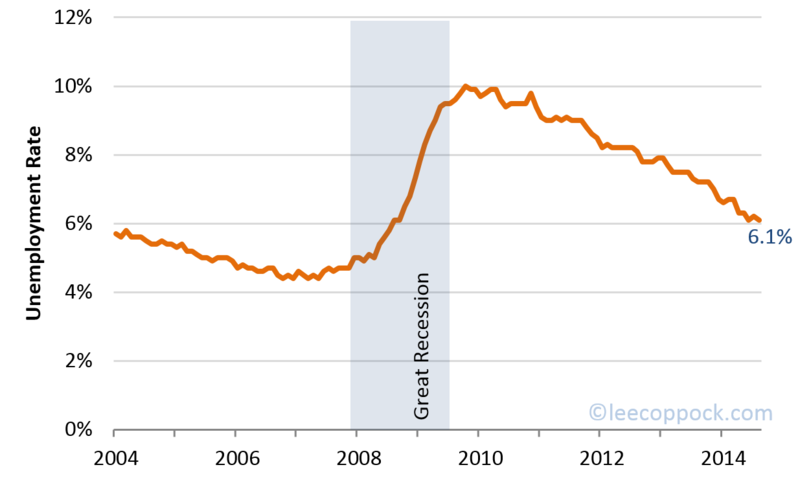

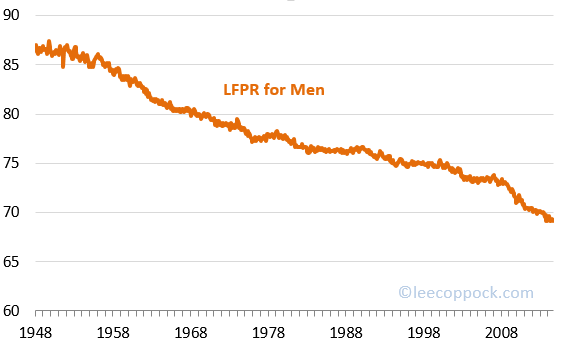

I've blogged about this before (see here), but the labor force participation rate (LFPR) just keeps falling. Nobody sees this as positive news – more and more U.S. workers are sitting on the sidelines. The latest jobs report brought the good news of a falling unemployment rate, but part of this is because workers are leaving the labor force. As the graph below shows, the overall LFPR in the U.S. is now down to 62.7 percent, which is the lowest it has been since many women entered the labor force in the 1960s and 70s.

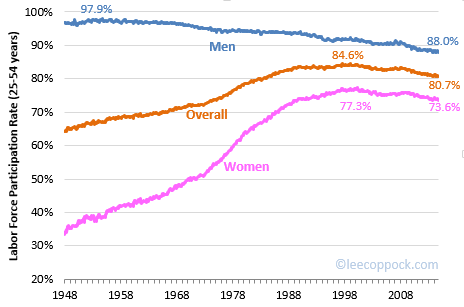

Also, let's not conclude that this is all due to the aging of the baby boomers. As Michael Strain recently noted in a series of tweets (here is one), the LFPR is declining even among those aged 25-54. The LFPR for this age group is plotted below.